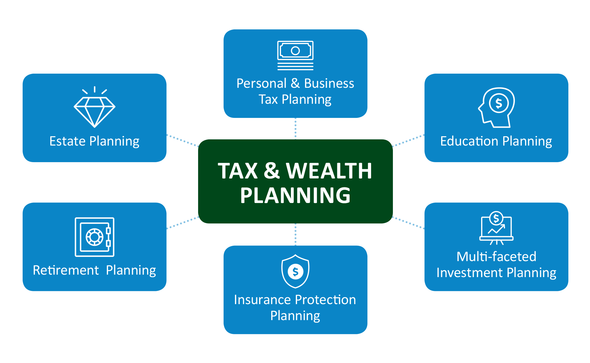

We have a passion for our mission - helping our clients achieve sound financial health and understanding. Achieving this takes careful planning with wisdom, insight and experience. We use a disciplined, structured approach to planning to ensure that your needs, goals and objectives are incorporated into developing a plan that 's best for you.

Newsletters

-

Consumer Sentiment: Do Americans See Brighter Days Ahead?

Why do policymakers pay attention to how consumers are feeling, and what’s behind Americans’ lack of confidence?

-

Eight Great Investing Quotes

This article offers eight quotes from successful investors, economists, and other insightful thinkers that may help provide perspective and focus for an investing strategy.

-

FAFSA for 2025-2026 School Year Opens December 1

Following a disastrous rollout last year, this article provides tips for submitting the redesigned Free Application for Federal Student Aid (FAFSA) for the 2025–2026 school year.

-

QLACs: Your Retirement Accounts Can Act Like Pensions

With a qualified longevity annuity contract, or QLAC, a retiring worker can use a portion of their tax-deferred savings to set up a lifetime income stream that begins at an older age.

Calculators

-

Savings Goals

How much do you need to save each year to meet your long-term financial goals?

-

College Funding

Use this calculator to estimate the cost of your child’s education, based on the variables you input.

-

Cash Flow Analysis

This Cash Flow Analysis form will help you weigh your income vs. your expenses.

-

LTCI Cost of Waiting

Estimate the potential cost of waiting to purchase a long-term care insurance policy.